-

×

Burnova Plus Gel Aloe and Plankton 25g

2 × 3.72 $

Burnova Plus Gel Aloe and Plankton 25g

2 × 3.72 $ -

×

Aloe Vera Gel Burnova Plus snow Algae 25g

2 × 3.72 $

Aloe Vera Gel Burnova Plus snow Algae 25g

2 × 3.72 $ -

×

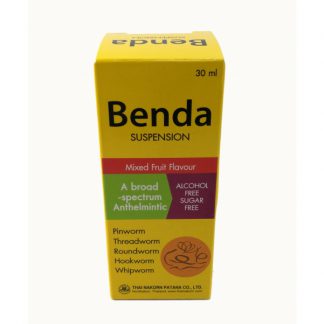

Benda Anthelmintic Suspension (30 ml)

1 × 2.66 $

Benda Anthelmintic Suspension (30 ml)

1 × 2.66 $ -

×

Drops for eye fatigue Allergis 5 ml

6 × 2.79 $

Drops for eye fatigue Allergis 5 ml

6 × 2.79 $ -

×

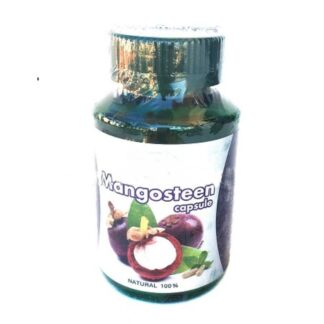

Mangosteen Capsule 100% natural 30 capsules

1 × 6.51 $

Mangosteen Capsule 100% natural 30 capsules

1 × 6.51 $ -

×

Compound Kamincur Capsule Thanyaporn Brand

1 × 5.12 $

Compound Kamincur Capsule Thanyaporn Brand

1 × 5.12 $ -

×

Wang prom yellow balm (50 gr)

10 × 3.07 $

Wang prom yellow balm (50 gr)

10 × 3.07 $ -

×

Sheep Placenta Cream

1 × 6.82 $

Sheep Placenta Cream

1 × 6.82 $ -

×

Nida Trinolone Oral Paste for treatment of stomatitis

8 × 2.56 $

Nida Trinolone Oral Paste for treatment of stomatitis

8 × 2.56 $ -

×

Drinking marine collagen for beauty and health Donutt

1 × 15.89 $

Drinking marine collagen for beauty and health Donutt

1 × 15.89 $ -

×

Propoliz mouth spray

1 × 6.14 $

Propoliz mouth spray

1 × 6.14 $ -

×

Hamar longan Foot Pain cream

1 × 6.31 $

Hamar longan Foot Pain cream

1 × 6.31 $ -

×

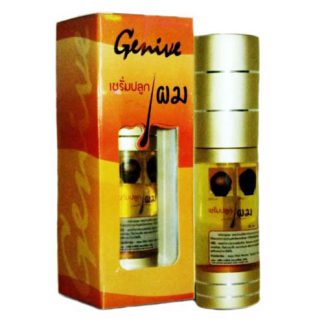

Genive Thai baldness tonic

1 × 3.75 $

Genive Thai baldness tonic

1 × 3.75 $ -

×

Pineapple oil Balm

1 × 1.19 $

Pineapple oil Balm

1 × 1.19 $ -

×

Wang Prom DARK BLUE BALM (50 gr)

1 × 3.03 $

Wang Prom DARK BLUE BALM (50 gr)

1 × 3.03 $ -

×

Herbal Relief Pain Oil RASYAN (20 ml or 50 ml) - 20 ml

1 × 3.72 $

Herbal Relief Pain Oil RASYAN (20 ml or 50 ml) - 20 ml

1 × 3.72 $ -

×

Thai green balm Wang Prom - 50g

1 × 3.75 $

Thai green balm Wang Prom - 50g

1 × 3.75 $ -

×

Holika Aloe 99% Universal Gel

1 × 3.31 $

Holika Aloe 99% Universal Gel

1 × 3.31 $ -

×

Genive Hair Loss Serum

1 × 6.82 $

Genive Hair Loss Serum

1 × 6.82 $ -

×

Centella cream for scars, stretch marks and wound healing

2 × 1.53 $

Centella cream for scars, stretch marks and wound healing

2 × 1.53 $ -

×

Aloe vera 99% Magic Lip

1 × 1.33 $

Aloe vera 99% Magic Lip

1 × 1.33 $ -

×

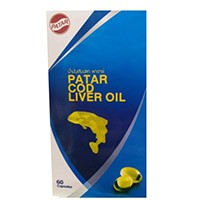

Cod liver oil capsules (60 capsules)

1 × 5.18 $

Cod liver oil capsules (60 capsules)

1 × 5.18 $ -

×

Healing oil with chlorophyll

1 × 3.51 $

Healing oil with chlorophyll

1 × 3.51 $ -

×

Tablets - cough drops and for fresh breath

2 × 0.83 $

Tablets - cough drops and for fresh breath

2 × 0.83 $

Subtotal: 172.56 $

Total Weight: 4.395 kg

Burnova Plus Gel Aloe and Plankton 25g

Burnova Plus Gel Aloe and Plankton 25g  Aloe Vera Gel Burnova Plus snow Algae 25g

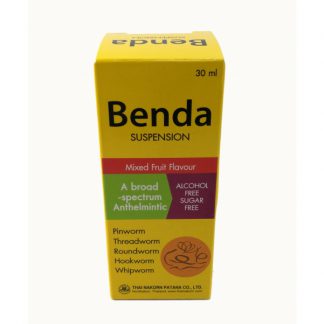

Aloe Vera Gel Burnova Plus snow Algae 25g  Benda Anthelmintic Suspension (30 ml)

Benda Anthelmintic Suspension (30 ml)  Drops for eye fatigue Allergis 5 ml

Drops for eye fatigue Allergis 5 ml  Mangosteen Capsule 100% natural 30 capsules

Mangosteen Capsule 100% natural 30 capsules  Compound Kamincur Capsule Thanyaporn Brand

Compound Kamincur Capsule Thanyaporn Brand  Wang prom yellow balm (50 gr)

Wang prom yellow balm (50 gr)  Sheep Placenta Cream

Sheep Placenta Cream  Nida Trinolone Oral Paste for treatment of stomatitis

Nida Trinolone Oral Paste for treatment of stomatitis  Drinking marine collagen for beauty and health Donutt

Drinking marine collagen for beauty and health Donutt  Propoliz mouth spray

Propoliz mouth spray  Hamar longan Foot Pain cream

Hamar longan Foot Pain cream  Genive Thai baldness tonic

Genive Thai baldness tonic  Pineapple oil Balm

Pineapple oil Balm  Wang Prom DARK BLUE BALM (50 gr)

Wang Prom DARK BLUE BALM (50 gr)  Herbal Relief Pain Oil RASYAN (20 ml or 50 ml) - 20 ml

Herbal Relief Pain Oil RASYAN (20 ml or 50 ml) - 20 ml  Thai green balm Wang Prom - 50g

Thai green balm Wang Prom - 50g  Holika Aloe 99% Universal Gel

Holika Aloe 99% Universal Gel  Genive Hair Loss Serum

Genive Hair Loss Serum  Centella cream for scars, stretch marks and wound healing

Centella cream for scars, stretch marks and wound healing  Aloe vera 99% Magic Lip

Aloe vera 99% Magic Lip  Cod liver oil capsules (60 capsules)

Cod liver oil capsules (60 capsules)  Healing oil with chlorophyll

Healing oil with chlorophyll  Tablets - cough drops and for fresh breath

Tablets - cough drops and for fresh breath